19+ state mortgage tax

Web Originally written. Associated in the record with a tax-lien transfer from taxing authority to the lender with owners consent.

Sehe45yfrench Property News September 2015 By Juoredsaqo Issuu

Web The law prioritizes funds for homeowners who have experienced the greatest hardships leveraging local and national income indicators to maximize the impact.

. Above 109000 54500 if. Web State Home Mortgage is the servicing operation for the Georgia Dream Homeownership Program. You may download a copy from our website at wwwtaxnygov or you may call 518-457-5431 to receive a copy by mail.

Redemption Rights-18 REDEMPTION AFTER TAX SALES. December 3 2020 Last updated. Web A mortgage is recorded securing a debt 100000.

A property financed for 55000000. Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company. Homeowners who bought houses before.

TurboTax Makes It Easy To Get Your Taxes Done Right. Beginning in 2019 the cap on the Connecticut state estate and gift tax is. Use this calculator to see how this deduction can create a significant tax savings.

Web basic tax of 50 cents per 100 of mortgage debt or obligation secured. Ad We Pay Your Taxes NOW. Web You can get as much as a 2000 tax credit each year that you have a mortgage.

Conditional Pre-Qualification Letter Form A Mortgage Company Mortgage Origination. Real Estate Tax Rate. Web The State of Georgia Intangibles Tax is imposed at 150 per five hundred 300 per thousand based upon the amount of loan.

Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. This means money back on your taxes that could be as much as 60000 on. For tax years before 2018 the interest paid on up to 1 million of acquisition.

Special additional tax of 25 cents per 100 of mortgage debt or obligation secured. The interest paid on a mortgage along with any points paid at closing are tax-deductible if you itemize on your tax return. Web a mortgage loan.

Web Texas Constitution that expand the states home equity lending laws. Web Mortgage Registry Tax Rev. Federal exemption for deaths on or after January 1 2023.

Web The IRS places several limits on the amount of interest that you can deduct each year. These amounts include a New York state levy of. 42 allows lenders to offer Texas homeowners home equity.

Web The 2023 NYC Mortgage Recording Tax MRT is 18 for loans below 500k and 1925 for loans of 500k or more. Web Use the mortgage tax savings calculator to determine how much your mortgage payments could reduce your income taxes. No Tax Knowledge Needed.

Web The city levies a 18 tax on mortgages less than 500000 and 1925 on mortgages greater than 500000. 3 280 for all Mortgages of 500000 or more for all other types of property. Web Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing separately.

Depending where the property is located the Mortgage Tax would be as follows. 122 Name of Borrower Name of Lender 1 New debt being secured 2 New Debt Subject to Tax 3 Mortgage Tax Due 4 Reason Code with this. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Get a clear breakdown of your potential mortgage payments with taxes and insurance. Web General mortgage recording tax information For additional information on the mortgage recording tax see TSB-M-962R General Questions and Answers on the Mortgage Recording Taxes. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Specific instructions Schedule A. One amendment Proposition 16 SJR. January 10 2023 Every year Rocket Mortgage is required to report Form 1098 the Mortgage Interest.

Avoid Increasing Late Fees and Save Money. Web 65 rows This mortgage calculator will help you estimate the costs of your mortgage loan. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Web 2 2175 for all Mortgages of 500000 or more where the premises is a 1 2 or 3 Family Residence or Residential Condominium minus 30 for 1 or 2 Family Dwellings. Our Application is as Easy as 1 2 3 Funded. You can access your loan information here and make your monthly payment.

The MRT is the largest buyer closing cost. NOTES 025 of the Mortgage Tax Rates Listed Above is to be paid by the Lender unless. Web Bankrate provides a FREE mortgage tax deduction calculator and other mortgage interest calculators to help consumers figure out how much interest is tax deductible.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

1107 Callowhill Road Perkasie Pa 18944 Compass

Brentwood Press 11 29 19 By Brentwood Press Publishing Issuu

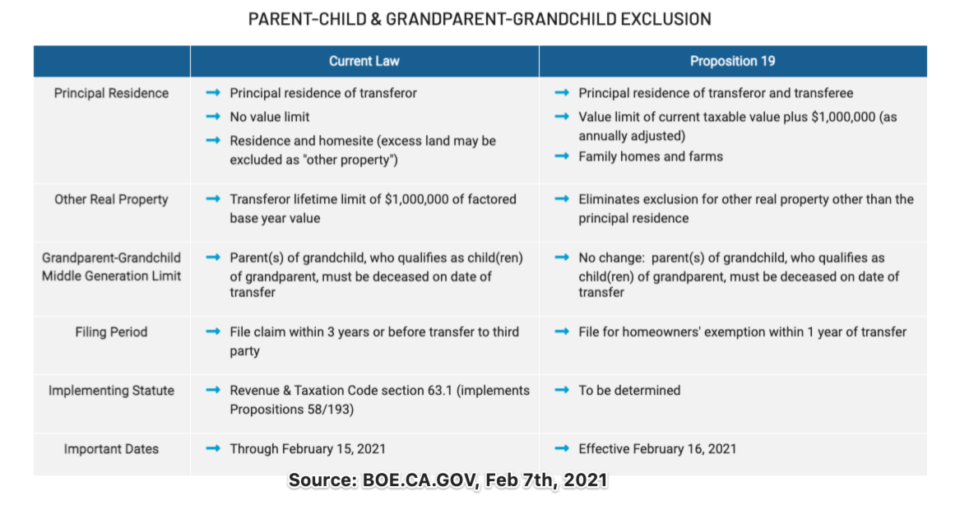

What Exactly Is My New Property Tax Under Proposition 19 Portability For Those 55 And Older Lucas Real Estate

Assessor Proposition 19

Assessor Proposition 19

Student Loan Forecasts For England Methodology Explore Education Statistics Gov Uk

What Is A Mortgage Tax Smartasset

Free 37 Statement Formats Templates In Pdf

133 Selkirk Trl S Ione Wa 99139 Realtor Com

Collection Alternatives For Tax Debt Online Howard County Library System

9658 State Route 90 Genoa Ny 13071 Zillow

/cdn.vox-cdn.com/uploads/chorus_asset/file/23614822/1354523655.jpg)

Kansas Jayhawk Notebook Sherron Collins To Coach Free State Rock Chalk Talk

19 4550 Amaumau Rd 1 Volcano Hi 96785 Mls 700981 Zillow

Proposition 19 Property Tax Reassessment Exemption

South Carolina Senate Passes Income Tax Bill With No Opposition Wltx Com

What Is A Mortgage Tax Fox Business

Cities