Rental real estate depreciation calculator

It can be used to offset up to 25000 in earned income as long as you actively managed the real estate and earned less than 100000 during the year. Depreciation is limited on automobiles and other property used for transportation and property of a type generally used for entertainment recreation or amusement.

Depreciation For Rental Property How To Calculate

A federal tax deduction of up to 25000 that is available to non-real estate professionals who own at least a 10 interest in a rental property that they.

. Read How to Avoid Depreciation Recapture Tax on Rental Property. Real Estate Investment Calculator. Mark Ferguson is the author and creator of InvestFourMore.

Residential and rental owners need to know deducing their costs in their real estate. This class also includes appliances carpeting and furniture used in a residential rental real estate activity. Free rental property Income calculator that I used to model hundreds of deals and build a 15 million-dollar portfolio with great cash flow.

LEARN MORE. It allows you to deduct the costs from your taxes of buying and improving a property over its useful life and thus. Adjust any of the inputs and the results will instantly update to reflect the changes.

Mark started Blue Steel Real Estate a. Lets look at an example to illustrate depreciation recapture in the real world. Its building value because land cant be depreciated.

See chapter 5 of Pub. You claimed more or less than the allowable depreciation on a depreciable asset. The math is a bit more complex than well want to dive into here but to get a ballpark of your expenses you can enter the cost of your property and other variables into a property depreciation.

Mark has flipped over 175 homes including 26 in 2017 and 26 in 2018. Lower rates for long-term capital gains. Here are a few of the most common liens against real estate youll encounter.

Ben has a rental portfolio of 22 doors and has used the calculators in this article. Residential rental property is estimated to have 275 years lifespan while useful life of 39 years includes commercial estates and home offices disregarding land value. The rental real estate loss allowance is what the IRS allows you to deduct in passive losses from real estate each year from your earned income.

An investor buys a duplex for 500000 building value. Ben Mizes is a real estate investor licensed real estate agent and CEO of Clever Real Estate. Claiming catch-up depreciation is a change in the accounting method.

Add your information in the green boxes to instantly calculate the ROI cash flow and IRR. As outlined above there are many types of liens on property. This allows them to pay their taxes accordingly and improve.

We have created a glossary of the most commonly used real estate terms and their definitions in order to help you better understand terminology used along your home buying or selling process. Types of Real Estate Liens. Real estate investing offers several tax advantages.

Real estate appraisal property valuation or land valuation is the process of developing an opinion of value for real property usually market valueReal estate transactions often require appraisals because they occur infrequently and every property is unique especially their condition a key factor in valuation unlike corporate stocks which are traded daily and are. Real estate depreciation is an important tool for rental property owners. Rental Real Estate Loss Allowance.

Analyze the value of purchasing an investment property or renting your home or condo with the calculator below. Available online or as an app for iPhone iPad and Android phone or tablets for use anytime anywhere the BMT Tax Depreciation Calculator is an indispensable tool for anyone involved in property investing. You didnt claim depreciation in prior years on a depreciable asset.

Our tool is renowned for its accuracy and provides usable figures and a genuine insight into the potential cash returns you could expect from an investment property. Real estate tends to appreciate over time so its common for real estate investors to sell a. As the most common lien against real property homeowners and real estate investors voluntarily agree to mortgage liens when they borrow money against a property.

Catch-up depreciation is an adjustment to correct improper depreciation. Mark also owns 20 rentals including a 68000 square foot commercial strip mall. If you sell rental or investment property you can avoid capital gains and depreciation recapture taxes by rolling the proceeds of your sale into a similar type of investment within 180 days.

Real estate economics is the application of economic techniques to real estate marketsIt tries to describe explain and predict patterns of prices supply and demandThe closely related field of housing economics is narrower in scope concentrating on residential real estate markets while the research on real estate trends focuses on the business and structural changes affecting. There is a lot of real estate terminology used during the home buying and selling process and CENTURY 21 is here to help you understand those terms.

Rental Property Depreciation Rules Schedule Recapture

Straight Line Depreciation Calculator And Definition Retipster

Macrs Depreciation Calculator With Formula Nerd Counter

How To Use Rental Property Depreciation To Your Advantage

How To Calculate Depreciation Expense For Business

How To Calculate Depreciation On Rental Property

Depreciation Calculator Depreciation Of An Asset Car Property

Straight Line Depreciation Calculator And Definition Retipster

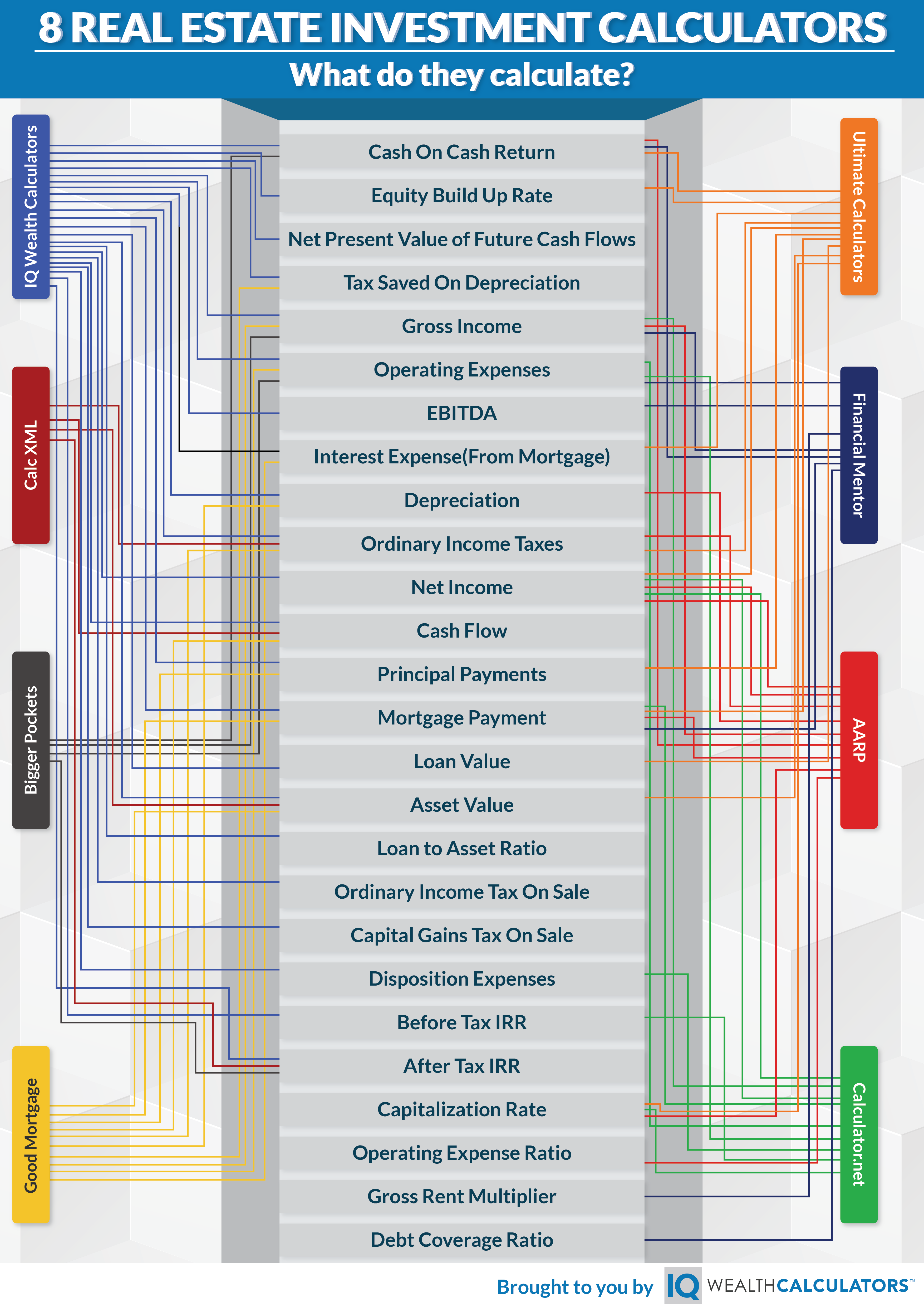

8 Powerful Real Estate Investment Calculators A Full Review

How To Calculate Depreciation On A Rental Property

Macrs Depreciation Calculator

Real Estate Depreciation Meaning Examples Calculations

Macrs Depreciation Calculator Irs Publication 946

Rental Property Depreciation Rules Schedule Recapture

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Depreciation Schedule Formula And Calculator Excel Template

Macrs Depreciation Calculator With Formula Nerd Counter